Introduction

Embarking on the journey to buy your first car is an exhilarating experience filled with both excitement and a bit of anxiety. Whether you’re eyeing that sleek, exotic car or something more practical, getting the keys to your own vehicle marks a pivotal moment in your life. This guide is designed to simplify the process, shedding light on crucial steps and offering expert tips to ensure you make a well-informed decision. From understanding your budget to selecting the right car and navigating through the paperwork, get ready to steer through the car buying process with confidence!

Tips for First-Time Car Buyers

Researching Different Car Models

Embarking on the journey to purchase your first car is thrilling, yet it demands careful thought and research. Start by assessing what type of vehicle best suits your lifestyle. Are you looking for an eco-friendly sedan for city driving or perhaps a more robust SUV for off-road adventures? Once you’ve pinpointed the category, delve into the specifics. Utilize resources like Kelley Blue Book or Car and Driver to compare safety features, fuel efficiency, and consumer reviews. These insights will guide you in narrowing down your choices to a few top models. Also, consider the longevity of the car’s design and technology, ensuring it remains compatible with future upgrades and changes.

Setting a Realistic Budget

Financial prudence is key when buying your first car. Start by calculating your monthly income and expenses to determine how much you can comfortably allocate to a car payment. Remember to include ongoing costs like fuel, insurance, maintenance, and yearly registration fees. A general rule of thumb is that your car payment should not exceed 15% of your monthly take-home pay. Also, prepare for upfront expenses such as down payments and taxes. Using online car affordability calculators can help you visualize the financial impact and keep your spending in check.

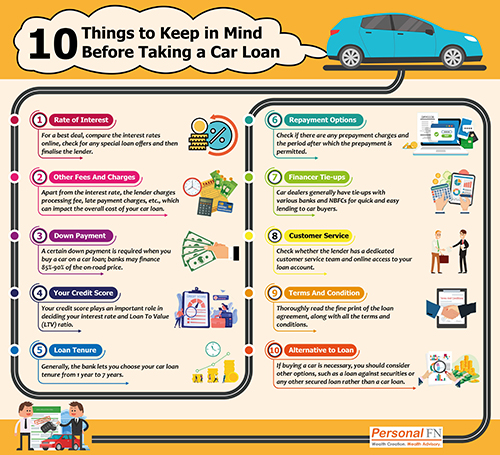

Understanding Car Financing Options

Navigating the world of car financing can sometimes seem like walking through a maze. However, understanding your options can lead to a much smoother buying experience.

Loan Pre-Approval Process

Getting pre-approved for a car loan is a savvy step for any first-time buyer. This process involves applying for a loan with a bank, credit union, or online lender before you visit the dealership. The lender will perform a “soft” credit check, which won’t impact your credit score, to evaluate your creditworthiness and determine the amount they’re willing to lend. Benefits of pre-approval include knowing exactly how much you can afford, gaining leverage in price negotiations, and ensuring you get a competitive interest rate. Always compare offers from multiple lenders to ensure the best deal.

Exploring Financing Terms

Understanding the terms of your financing agreement is crucial to ensure it meets your budget needs and doesn’t lead to financial strain down the road. Key factors to consider are the loan term (often 36, 48, 60, or 72 months), the interest rate, and the monthly payment amount. Shorter loan terms typically have higher monthly payments but lower overall interest costs. Conversely, longer terms spread out the payment but accrue more interest. Always read the fine print for additional fees or penalties, such as early repayment charges.

Importance of Credit Score

Your credit score plays a pivotal role in the car buying process, influencing both your loan approval and the interest rates offered to you. Higher scores generally unlock lower rates, making the loan less expensive over time. Before you start car shopping, check your credit score and report for any discrepancies that could affect your financing. If your score is lower than desired, consider postponing your car purchase to improve it. Paying down outstanding debts and making bill payments on time are effective strategies to boost your credit rating before applying for a car loan.

Visiting Dealerships and Test-Driving Cars

Visiting dealerships and test-driving cars are crucial steps in the car buying process, especially for first-time buyers. This stage not only gives you a feel of the car but also offers a practical perspective beyond specs and reviews.

Finding Reputable Dealers

When it comes to finding reputable dealers, start with a bit of research. Check online reviews and ratings on platforms such as Google and Yelp. Ask friends and family for recommendations, particularly noting those who had good experiences. It’s wise to choose a dealer that has a strong reputation for customer service and fair pricing. Additionally, checking with the Better Business Bureau (BBB) can provide insights into any major complaints or issues that other customers have reported. Always aim to visit several dealerships so you can compare environments and experiences. This variety will give you a broader understanding of options and what feels right for you.

Tips for Test-Driving

Test-driving is more than just taking the car for a spin. Before you head out, make a list of the cars you are most interested in and schedule appointments to avoid waiting. When test-driving, pay attention to every aspect of the car:

– Comfort: Is the seating comfortable? Can you adjust the seat easily?

– Visibility: Check if you can see all around the vehicle without strain.

– Controls: Make sure that all controls are easy to reach and operate.

– Performance: Pay attention to how the car accelerates, brakes, and handles different road conditions.

– Noise: Listen for any unusual engine or road noise.

Express any concerns you might have to the dealer and see how they respond. A good dealer will be patient and informative.

Evaluating Car Listings and Negotiating Prices

Once you’ve test-driven some cars and narrowed down your options, it’s time to look more closely at car listings and start thinking about price negotiation.

Strategies for Negotiating with Dealers

Negotiating with car dealers can be daunting, but it’s crucial to ensuring you get a fair deal. Here are strategies to help:

– Be informed: Enter negotiations with all the information about the car’s value and any competing listings you’ve gathered.

– Stay calm and polite: Keeping negotiations friendly and professional increases the likelihood of a favorable outcome.

– Start low: Begin with an offer that is lower than your target price to give room for negotiation.

– Be ready to walk away: Showing you’re not desperate to buy can sometimes result in the dealer making a better offer.

Through employing these tactics, you can navigate dealership visits and negotiations more confidently, bringing you a step closer to purchasing your ideal first car.

Securing Car Insurance and Understanding Coverage

Importance of Car Insurance for New Drivers

Buying your first car is an exhilarating experience, but it’s also accompanied by significant responsibilities, one of which is securing car insurance. For new drivers, car insurance isn’t just a legal requirement—it’s a critical layer of financial protection. Accidents, as you know, can happen to anyone, regardless of driving expertise. Insurance helps cover costs that can otherwise drastically impact your finances, including vehicle repairs, medical bills, and liabilities in case someone else is hurt or their property is damaged in an accident involving your car.

Types of Coverage to Consider

When selecting car insurance, you’ll encounter various types of coverage options, each serving different purposes:

– Liability Insurance: Essential for all drivers, this covers injuries to other people and damages to their property.

– Collision Coverage: This pays for damage to your car after an accident involving another vehicle.

– Comprehensive Coverage: This provides coverage against theft and damage caused by an incident other than a car crash, such as fire, flood, or vandalism.

– Personal Injury Protection (PIP): Helps with medical expenses for you and your passengers and can also cover lost wages and other related costs.

– Uninsured/Underinsured Motorist Protection: Useful if you’re involved in an accident with someone who either doesn’t have enough insurance or none at all.

Factors Affecting Insurance Rates

Several elements determine the cost of your car insurance:

– Type of Car: High-performance or expensive cars typically cost more to insure.

– Deductible: Choosing a higher deductible can lower your premiums, but you’ll pay more out of pocket if an accident happens.

Conclusion

Purchasing your first car is a significant milestone filled with excitement and lots of decision-making. Remember, choosing the right car involves more than just its looks or speed. Safety features, reliability, and affordability should be your top priorities. Always take the time to thoroughly research, compare prices, and test drive multiple cars before making your final decision. Lastly, remember to review all the financial terms and conditions before signing any contracts. By following these guidelines, you’ll feel confident and prepared as you transition into car ownership. Happy driving!